Just yesterday - almost literally, the news was that House Flipping is Down. Now, the news is that House Flipping is strong! What gives?

After reading an article published by Housing Wire, and written by Jessica Guerin, I want to share with you the statistics show that house flipping is strong again. The number of homes flipped in America is approaching its high of 2006, just before the crash.

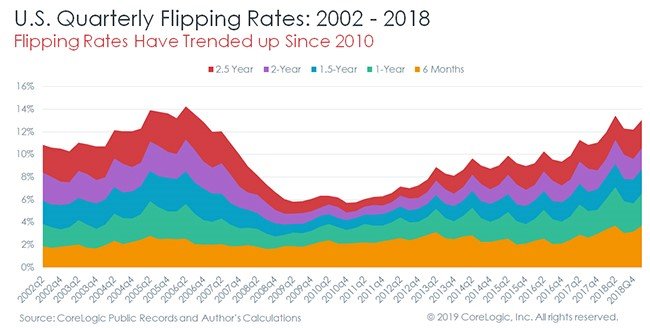

The latest data from CoreLogic reveals that 10.9% of all home sales in the fourth quarter of 2018 were flips, or homes that have been occupied for two years or less. This is the highest rate since the housing bubble days of 2006, when flips comprised 11.4% of home sales. (See chart below)

House Flipping accounts for close to 15% of the current home sales in America

The overzealous speculation of house flippers in the months leading up to the crisis is often cited as a contributing factor to the housing bubble. So should we be worried now that houses built on spec appear to be making a comeback?

No, says CoreLogic, citing evidence suggesting that the business practices of flipping is far better than what it used to be. Flippers are much more educated today, then they were 13 years ago. Instead of flipping homes based solely on price speculation, investors are flipping with a focus on adding real value to properties.

At Oregon Real Estate Investors our motto last year was “Making Neighborhoods Great Again!” as the majority of the members were focused on Flipping. Many of our purchases are distressed properties that need cleaning out, structure work, new windows, new doors, a roof and lots of paint. We get the unpleasant odors out of the house before we do anything else. Our work improves the value of the house, while also improving the value of the neighborhood.

Those of us who buy homes directly from the sellers and then fix them up, and put them on the market know the value of creative offers, the kind of purchase agreements that help the seller with their issues and help them move forward with the sale of their property.

We believe that House Flipping is strong, and helps the local economy more than building new-build houses. We focus on making houses available for the entry level house buyer. Some of us stay away from high-priced upper end homes. That’s why you will find that many of our flips are two-bedrooms, one-bath houses. We do several three-bed, two-bath houses too. We find that these are the homes that there is the most demand for, and that is another reason we believe House Flipping is Strong. While other members have ventured into flipping larger homes that need just as much repair as those in lower-income areas. It’s important that flippers who have ventured into homes that are priced above the median need to make sure they have the best representation by a very qualified real estate broker. Pictures and getting other brokers to tour the home is of utmost importance when the property’s ticket price is above the median price. Currently the median price is $312,800 per Zillow.com

CoreLogic found that returns are greatest in markets where there is a high percentage of flips on older homes. “We’ve seen growing signs that flippers are getting increasingly good at buying properties at a discount while the premium they’re selling for has remained mostly constant,” CoreLogic noted. “This is yet more evidence that flipping today is less risky and less speculative than during the 2000s.”

While these flips may require more cash, the payoff, in the end, the profit can be greater. There is a gamble in every home, and if you have not invested in that flip that is costing you more than it’s worth; most likely you will someday. We all have that one opportunity to learn a lesson.

“Flips undertaken on older homes likely require more capital to bring the home up to market standard than newer homes. Such updates [might] include costly improvements to electrical systems, plumbing, foundations, and roofing,” CoreLogic said, adding that “flippers are likely to reap substantial discounts when buying properties with such deferred maintenance.”

You can read more about the flipping house market in this CoreLogic article.